Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name . You might pay sdlt when you transfer a share in a. you usually do have to pay stamp duty on transfer of property between spouses unless there is no consideration and no change in mortgage liability; will i pay stamp duty when transferring my property into my partner's name? you may have to pay stamp duty land tax (sdlt) if the ownership of land or property is transferred to you in exchange for any. stamp duty is the tax you must pay when you purchase a property or site leasehold, but also when you take out a mortgage in the. You will need to pay stamp duty on the transfer if the property is mortgaged. what stamp duty is payable when transferring an interest in a jointly owned property? The transfer by one spouse to the other of their share in the. There is no general exemption from sdlt for married. do you pay stamp duty when transferring property to family?

from propseller.com

stamp duty is the tax you must pay when you purchase a property or site leasehold, but also when you take out a mortgage in the. You might pay sdlt when you transfer a share in a. You will need to pay stamp duty on the transfer if the property is mortgaged. you may have to pay stamp duty land tax (sdlt) if the ownership of land or property is transferred to you in exchange for any. what stamp duty is payable when transferring an interest in a jointly owned property? will i pay stamp duty when transferring my property into my partner's name? do you pay stamp duty when transferring property to family? you usually do have to pay stamp duty on transfer of property between spouses unless there is no consideration and no change in mortgage liability; There is no general exemption from sdlt for married. The transfer by one spouse to the other of their share in the.

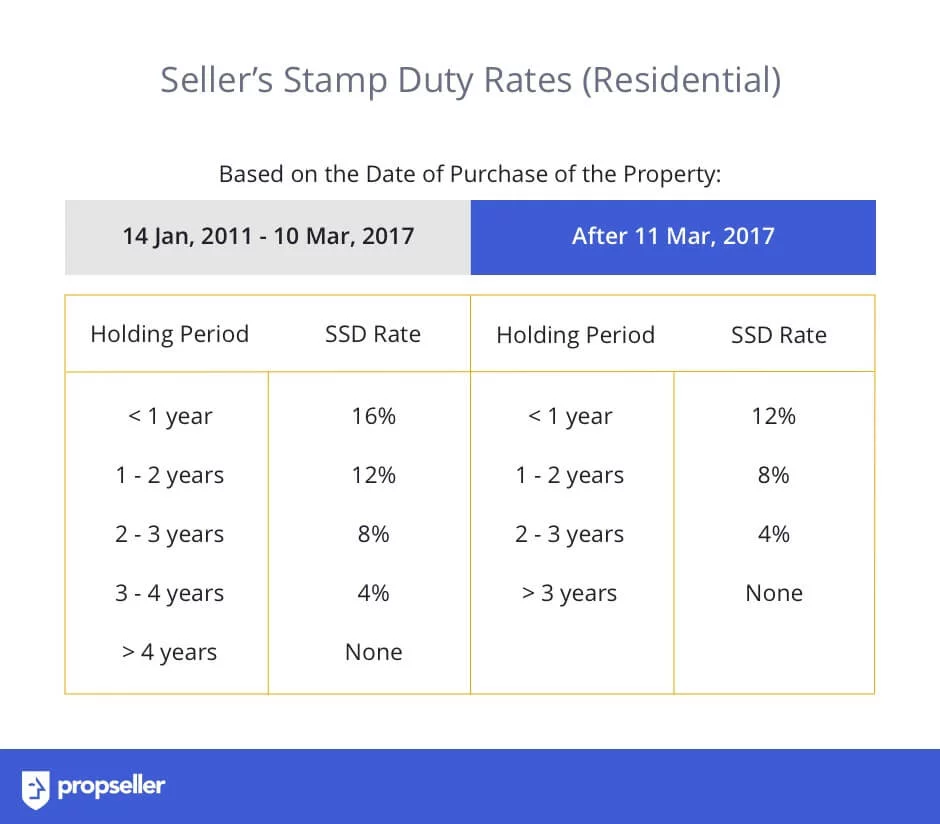

Stamp Duty in Singapore The Ultimate Guide 2020 Update Propseller

Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name You will need to pay stamp duty on the transfer if the property is mortgaged. You might pay sdlt when you transfer a share in a. what stamp duty is payable when transferring an interest in a jointly owned property? do you pay stamp duty when transferring property to family? You will need to pay stamp duty on the transfer if the property is mortgaged. will i pay stamp duty when transferring my property into my partner's name? There is no general exemption from sdlt for married. you may have to pay stamp duty land tax (sdlt) if the ownership of land or property is transferred to you in exchange for any. stamp duty is the tax you must pay when you purchase a property or site leasehold, but also when you take out a mortgage in the. you usually do have to pay stamp duty on transfer of property between spouses unless there is no consideration and no change in mortgage liability; The transfer by one spouse to the other of their share in the.

From www.smartsheet.com

18 Free Property Management Templates Smartsheet Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name what stamp duty is payable when transferring an interest in a jointly owned property? do you pay stamp duty when transferring property to family? you usually do have to pay stamp duty on transfer of property between spouses unless there is no consideration and no change in mortgage liability; You might pay sdlt when you transfer a. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From www.legalraasta.com

Partnership Deed importance Download Format of deed LegalRaasta Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name stamp duty is the tax you must pay when you purchase a property or site leasehold, but also when you take out a mortgage in the. You might pay sdlt when you transfer a share in a. The transfer by one spouse to the other of their share in the. you usually do have to pay stamp duty. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From www.rocketlawyer.com

Free Name Change Notification Letter Rocket Lawyer Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name You might pay sdlt when you transfer a share in a. do you pay stamp duty when transferring property to family? You will need to pay stamp duty on the transfer if the property is mortgaged. will i pay stamp duty when transferring my property into my partner's name? what stamp duty is payable when transferring an. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From www.slideserve.com

PPT Gender & Fiscal Policies PowerPoint Presentation, free download Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name stamp duty is the tax you must pay when you purchase a property or site leasehold, but also when you take out a mortgage in the. you may have to pay stamp duty land tax (sdlt) if the ownership of land or property is transferred to you in exchange for any. you usually do have to pay. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From www.ncertbooks.guru

Transfer Letter Format, Samples How to write a Transfer Request Letter? Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name you usually do have to pay stamp duty on transfer of property between spouses unless there is no consideration and no change in mortgage liability; stamp duty is the tax you must pay when you purchase a property or site leasehold, but also when you take out a mortgage in the. There is no general exemption from sdlt. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From www.iproperty.com.my

Malaysians' guide to the latest Property Stamp Duty Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name will i pay stamp duty when transferring my property into my partner's name? you usually do have to pay stamp duty on transfer of property between spouses unless there is no consideration and no change in mortgage liability; stamp duty is the tax you must pay when you purchase a property or site leasehold, but also when. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From ceprpxmr.blob.core.windows.net

Can You Look Up Property Deeds at Russel Blakeley blog Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name you usually do have to pay stamp duty on transfer of property between spouses unless there is no consideration and no change in mortgage liability; stamp duty is the tax you must pay when you purchase a property or site leasehold, but also when you take out a mortgage in the. The transfer by one spouse to the. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From attwells.com

Will I have to pay Stamp Duty Land Tax on transferring my property deeds? Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name you may have to pay stamp duty land tax (sdlt) if the ownership of land or property is transferred to you in exchange for any. There is no general exemption from sdlt for married. stamp duty is the tax you must pay when you purchase a property or site leasehold, but also when you take out a mortgage. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From www.uslegalforms.com

CA Trust Transfer Grant Deed Complete Legal Document Online US Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name will i pay stamp duty when transferring my property into my partner's name? There is no general exemption from sdlt for married. you usually do have to pay stamp duty on transfer of property between spouses unless there is no consideration and no change in mortgage liability; You will need to pay stamp duty on the transfer if. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From www.signnow.com

Partnership Resolution Sample Complete with ease airSlate SignNow Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name You might pay sdlt when you transfer a share in a. do you pay stamp duty when transferring property to family? The transfer by one spouse to the other of their share in the. you may have to pay stamp duty land tax (sdlt) if the ownership of land or property is transferred to you in exchange for. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From www.formsbirds.com

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name You will need to pay stamp duty on the transfer if the property is mortgaged. you may have to pay stamp duty land tax (sdlt) if the ownership of land or property is transferred to you in exchange for any. will i pay stamp duty when transferring my property into my partner's name? You might pay sdlt when. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From www.property118.com

Property118 Buying a new and selling existing main residence to ltd Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name You might pay sdlt when you transfer a share in a. what stamp duty is payable when transferring an interest in a jointly owned property? There is no general exemption from sdlt for married. you usually do have to pay stamp duty on transfer of property between spouses unless there is no consideration and no change in mortgage. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From www.youtube.com

“I’ll put the house in my partner's name”, is not an asset protection Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name do you pay stamp duty when transferring property to family? what stamp duty is payable when transferring an interest in a jointly owned property? you may have to pay stamp duty land tax (sdlt) if the ownership of land or property is transferred to you in exchange for any. You will need to pay stamp duty on. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From surfacesreporter.com

Real State Property Developers Maharashtra Builders Woo Homebuyers Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name you usually do have to pay stamp duty on transfer of property between spouses unless there is no consideration and no change in mortgage liability; do you pay stamp duty when transferring property to family? will i pay stamp duty when transferring my property into my partner's name? you may have to pay stamp duty land. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From www.docformats.com

Transfer Request Letter and Email (Format & Examples) Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name You might pay sdlt when you transfer a share in a. what stamp duty is payable when transferring an interest in a jointly owned property? do you pay stamp duty when transferring property to family? stamp duty is the tax you must pay when you purchase a property or site leasehold, but also when you take out. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From www.allbusinesstemplates.com

Property Ownership Transfer Letter Templates at Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name do you pay stamp duty when transferring property to family? what stamp duty is payable when transferring an interest in a jointly owned property? You will need to pay stamp duty on the transfer if the property is mortgaged. stamp duty is the tax you must pay when you purchase a property or site leasehold, but also. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From www.maxlandrea.com

MOT and Stamp Duty in Malaysia Maxland Real Estate Agency Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name you usually do have to pay stamp duty on transfer of property between spouses unless there is no consideration and no change in mortgage liability; You will need to pay stamp duty on the transfer if the property is mortgaged. do you pay stamp duty when transferring property to family? you may have to pay stamp duty. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.

From www.tiktok.com

trâm anh 98🥀 yêu là cưới 🥀 ️đutrend TikTok Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name you usually do have to pay stamp duty on transfer of property between spouses unless there is no consideration and no change in mortgage liability; will i pay stamp duty when transferring my property into my partner's name? The transfer by one spouse to the other of their share in the. do you pay stamp duty when. Will I Pay Stamp Duty When Transferring My Property Into My Partner S Name.